A stock average calculator is a handy tool for investors to monitor the trend of their portfolio. It streamlines the process of calculating the typical price of a group of stocks, providing valuable insights into investment trends. By adding stock prices into the calculator, users can receive an accurate representation of their portfolio's overall value. This information allows investors to make more informed decisions about buying, selling, or holding stocks.

Calculate Your Stock Portfolio Average

Determining the average price of your stock portfolio is a important step in monitoring your investments' performance. To determine this figure, you'll need to compile information about each stock in your portfolio, including its current share price and the number of shares you own. Multiply the share price by the number of shares for each stock, then website add together these values to get the total value of your holdings. Finally, separate this total value by the grand number of shares you own to arrive at your portfolio's average price per share.

By keeping track of this average over time, you can successfully monitor the development of your investments and make informed decisions about next purchases or sales.

Average Share Price Tool

An Average Share Price Tool is a valuable resource for investors and traders who want to gauge the performance of a specific stock. This software displays the average price of a share over a defined period. By examining this data, users can understand trends about the stock's volatility.

- Some Average Share Price Tools in addition provide advanced capabilities, such as price charts, which assist investors in making effective investment strategies.

- In essence, an Average Share Price Tool facilitates users to make smarter decisions regarding the securities they are interested in.

Figure Out Your Weighted Average Stock Price

Determining your weighted average stock price is a essential step in tracking the performance of your holdings. It provides a clear representation of the average cost per share you've paid for a particular stock, taking into account all past purchases. To calculate your weighted average stock price, initiate by collecting information on all your purchases for that particular stock. This includes the number of shares purchased and the price per share at the time of each transaction. Then, compute the total cost of each transaction by the number of shares acquired. Sum up these values to get your total expenditure. Finally, break down the total investment by the total number of shares you own. The resulting figure is your weighted average stock price.

Analyze Your Investment's Average Share Cost

When you invest in shares, it's crucial to monitor your average share cost. This number represents the average price you paid for each share over time. Figuring out this value can provide valuable insights into your portfolio's return. By knowing your average share cost, you can make more strategic decisions about your investments.

- Consistently review your investment portfolio and calculate your average share cost for each holding.

- Utilize online tools or spreadsheets to simplify this process.

- Monitor all your transactions, including the number of shares purchased and the price per share.

A Simple Stock Average Calculator

Determining the typical of your stock portfolio can be a key step in understanding its overall performance. Fortunately, calculating this average is a fairly simple process, even if you don't have a advanced financial background. With just a few steps, you can get a clear picture of how your stocks are acting as a whole.

- First, you'll need to gather the final values for each stock in your portfolio over a specified period of time.

- Then, sum all of these prices together.

- Last, separate the total sum by the quantity of stocks you own to arrive at your average stock price.

This simple approach can provide valuable insights into the health and potential expansion of your investment portfolio.

Tony Danza Then & Now!

Tony Danza Then & Now! Bug Hall Then & Now!

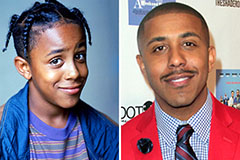

Bug Hall Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!